What are Debit Notes and Credit Notes? When do you need to use it?

- chatstickforbrand

- Nov 2, 2021

- 3 min read

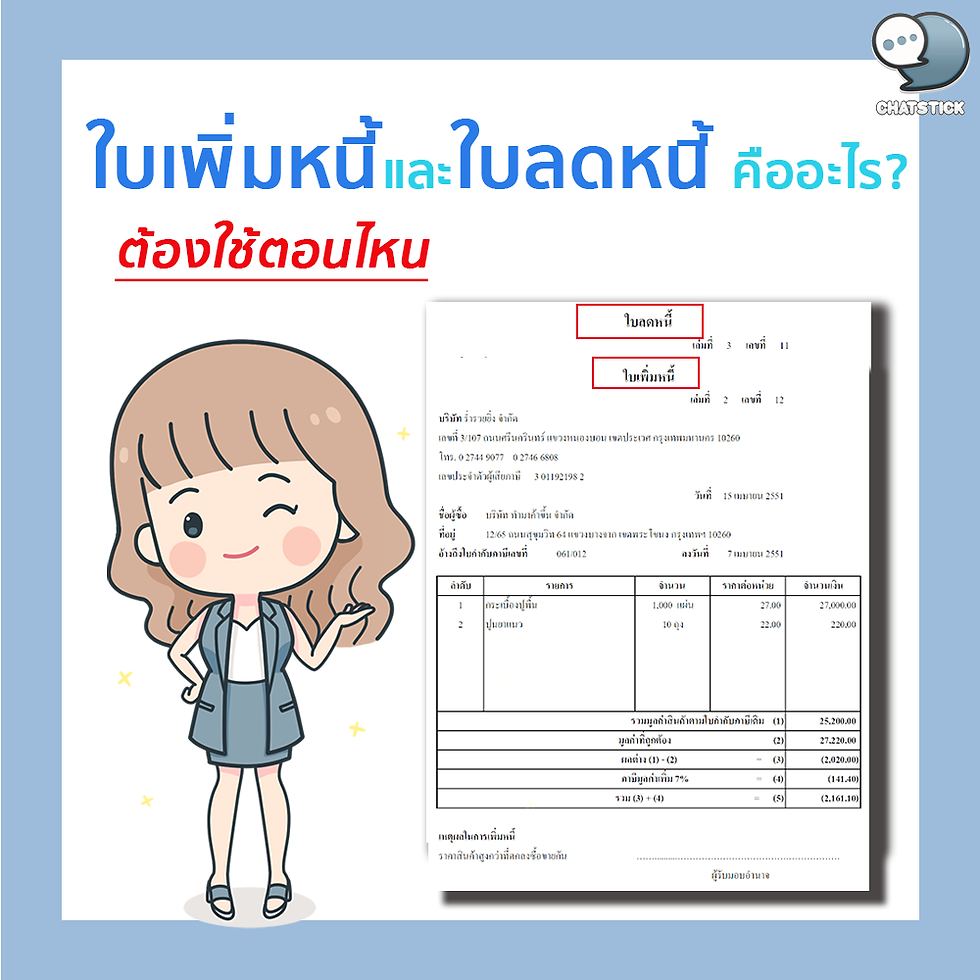

What are Debit Notes and Credit Notes? When do you need to use it?

It is not uncommon for a new accountant to or those who are studying for knowledge of accounting Will not know the debit note, reduce debt, which can be considered as an important item in accounting. to be used in specific cases which the debit note And the credit note has a slight effect on the accounting record. Because these two documents can be considered as a type of tax invoice document.

If you are a VAT registered entrepreneur have a sale And the issuance of tax invoices, debit notes and credit memos are very important to your business. Because issuing these two documents is like improving the input tax account. Sales that have been charged to increase or decrease, but of course there must be a reason for issuing both of these documents.

👉🏻The meaning of debit note and credit note

Debit Notes and Credit Notes are documents that entrepreneurs, department stores, and shops have to recalculate due to the product's value. or services have increased or decreased, issuing a debit note Or a credit note must be issued to the person who made the purchase. or service already by the person who issued the debit note or credit note must be an entrepreneur who has already registered for VAT As mentioned above The preparation of the debit note An escape note is usually generated when the following events occur:

1. Debit note

- Debit note is usually generated when the goods or the services purchased by the customer were sent out in excess of the agreed amount. or providing services beyond what was discussed before agreeing to purchase goods and services

- Debit note that was created because the operator calculates the price of the product. or service error which resulted in lower than the actual price

- Debit note that was created for other reasons as specified by the Revenue Department

2. Credit note

- Credit memos are usually generated when the product price and reduced service due to the delivery of the wrong product less than agreed (Not enough products) or services that are less than what has been discussed. (service defect)

- Credit note is created when the product price And the service was miscalculated causing the price to be higher than it really is.

- Credit memo is created when the operator receives the returned product (defective, broken, condition or property does not match the agreed upon)

- Credit memo is generated when the service contract is terminated. that the operator does not provide services under the contract

- A credit note is issued when compensation is paid to the buyer. from advance payments (security deposits, deposits) according to trade agreements

👉🏻How does the debit note and credit note affect our work?

If you are a VAT registrant who is a seller Will have the right to take the VAT on the credit note that you issued to “deduct” from your own sales tax in the month in which the credit note was issued. But if you are a VAT registrant who is a buyer is to do the opposite is to bring the VAT that appears on the credit note to “deduct” from your own input tax in the month that the credit note is received. Some of you may have questions. In this way, the goods that we receive back from the buyer from the issuance of the credit note. You don't have to take it to the warehouse anymore, because it's actually considered sold. It says that the importance of the credit memo lies in bringing the goods back into the warehouse as well. We cannot accept only the return of the documents. The product must be returned to the warehouse as well. Otherwise it cannot be assumed that the seller has received this return and issued a credit note.

👉🏻The essence of the debit note and debit note

For the complete debit note and credit note. It's almost like your familiar tax invoice. which must contain at least the following details:

1. See the words “Debit Notes” or “Debit Notes” clearly.

2. Date of issue

3. Have a taxpayer identification number including the name and address of the seller.

4. Buyer's name and address

5. The original tax invoice number

6. Value of goods or services according to the original tax invoice should be worth and the resulting difference

7. Brief Description about the reason for issuing debit note and credit note

-------------------------------------------------------------------------------------

Interested in online marketing care services | online marketing | complete graphics | can contact us anytime | brand building | online marketing | online marketing plan | brand building | Facebook fan page care | Take care of LINE OA. You can contact us 24 hours a day.

Details of online marketing services

Examples of various brands that we take care of online marketing

---------------------------------------------------------------------------------------

💙 Consult our team 💙

📱Tel : 0840104252 📱0947805680

Office Hotline : 034-900-165 , 02-297-0811 (Monday-Friday)

📨 Inbox : http://m.me/ChatStick.TH

┏━━━━━━━━━┓

📲 LINE: @chatstick

┗━━━━━━━━━┛

or click https://goo.gl/KuzCpM

🎉 details at http://www.chatstickmarket.com/langran

🎉 See our work at https://www.chatstickmarket.com/portfolio

Comments